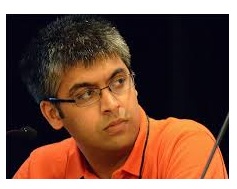

Post-Budget Reaction by Mr. Sitakanta Ray, Co-founder & Director, MySmartPrice.com

Budget 2015 has been a comprehensive one across spectrum covering not just welfare of the poor, the differently abled, the senior citizens but also the corporate sector especially the emerging sectors such as IT. For ecommerce in particular, while the dream of a tax holiday or FDI hasn’t come true, the introduction of GST in 2015-16 will greatly help the e-retailers who have been struggling with the differentiated tax laws.

Budget 2015 has been a comprehensive one across spectrum covering not just welfare of the poor, the differently abled, the senior citizens but also the corporate sector especially the emerging sectors such as IT. For ecommerce in particular, while the dream of a tax holiday or FDI hasn’t come true, the introduction of GST in 2015-16 will greatly help the e-retailers who have been struggling with the differentiated tax laws.

The Marquee of this budget has been the added benefits for entrepreneurs. The government allocation of Rs 1000 crores to create a SETU (self employment and talent utilization) scheme should greatly motivate young entrepreneurs. In addition to this, the reduction of Corporate Tax from 30% to 25% essentially increases the advantages of starting up verses working for a salaried job. Consolidating startup approvals through ebiz portal by including state approvals would certainly bring down the complexities in setting up business. Overall the budget has focussed on pushing the Make in India strategy by encouraging domestic industries and entrepreneurship and rewarding the Indian industries.